White Papers

Reliable Compensation Data As A Strategic Business Tool

Botoff Consulting, a US-based organization, continues to turn a spotlight on trends around family office compensation - a topic dear to the hearts of many FWR readers.

Editor’s note: We have known Trish Botoff and the Botoff team for some time and asked it for views on compensation data use, relevancy, and analysis. Botoff Consulting has also created a White Paper (more details below) and is due to publish its annual flagship US family office compensation survey in the next few weeks.

Since 2019, the number of family offices has increased by nearly a third to 8,030 since 2019 (source: Deloitte), sharpening competition for top-tier talent. In an increasingly crowded landscape, compensation packages have become a critical strategic tool to attract and retain bespoke family teams, a US consulting firm argues.

For most family offices and family organizations, compensation often is the most significant and visible annual expense for a family office, according to a paper from Botoff Consulting.

The firm says that tied to families’ financial goals and linked to their mission, vision, and values, compensation plans that strategically link these items can be leveraged as a powerful business tool that reduces ambiguity and align talent with family office goals; links rewards to defined performance and accountability expectations and offers families a powerful way to retain employees.

The firm poses the question on where should family principals and family office leaders begin when navigating pay, benefits, and incentives?

‚ÄúThe answer lies in leveraging quality, statistically sound, and contextually relevant data to guide decision-making,‚ÄĚ it says.

When considering any data source to inform compensation decisions, the report urges family offices to consider the following areas to determine the appropriateness of the data:

-- Use recent data collected within a defined and relevant

timeframe, rather than an open-ended or continuously evolving

dataset;

-- Employ data sets and/or custom peer groups reflecting the

most comparable type of firm, asset mix, or level of assets under

management (AuM);

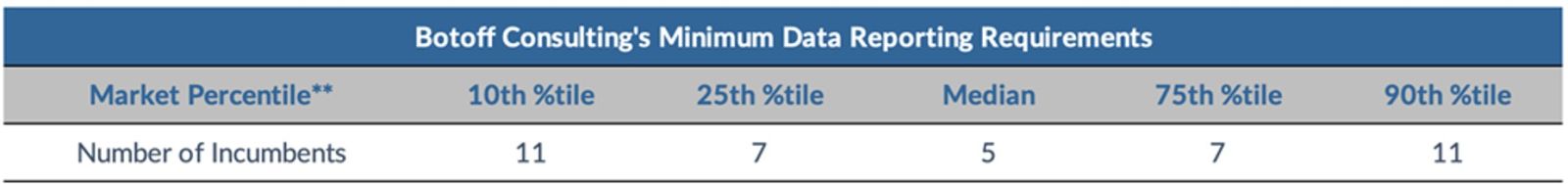

-- Ensure (see chart below) the sample size is sufficiently

robust to support meaningful conclusions (see chart

below);

-- Rely on data that is statistically validated and confirm

if the publisher of the data follows quantitative analysis best

practices;

-- Understand whether data is employer-reported (more

reliable) vs self-reported vs. anecdotal; and

-- Rely on reported median data vs average, as median is

more resistant to outliers.

A strategic differentiator comes from benchmarking compensation and incentive plans against industry best practices while considering the unique characteristics of an individual family office.

Unlike traditional corporate environments, family offices can vary widely in structure, purpose, and culture. A data-driven approach that accounts for these nuances will help ensure that compensation strategies are not only competitive but also aligned with the family’s values, long-term goals, and operating model. This level of customization is what sets high-performing family offices apart, the consultancy says.

**Mean not typically reported by Botoff due to impact of outliers

Implementing a data-driven compensation strategy transforms its compensation from a tactical decision to a strategic advantage, the report says.

The process includes an evaluation of family office structures, pay ranges, incentive plans, benefit packages, and total rewards strategies. Accurate benchmarking enables family offices to identify their competitive position, assess priorities and performance goals, and ultimately make better-informed decisions about compensation strategy and positioning.

Founded in 2014, Botoff Consulting says it has spent the past decade addressing and filling a critical gap in reliable, sector-specific data developed specifically for the family office space.

‚ÄúThe firm was built on a simple but powerful principle, ‚ÄėBad data is worse than no data at all,‚Äô and that has driven our firm to apply rigorous data integrity norms and practices to all of the information we collect and publish,‚ÄĚ Botoff Consulting founder and managing principal Trish Botoff, said in the paper.

Over the past decade, family offices have reported delivering steady, significant (above national average) increases in compensation, tied primarily to overall market, investment performance, and business performance, the report says. This performance-based trend fits with how family offices have got more professional and sophisticated. In surveys and practice, these offices report an increase in formal compensation strategy, including an emphasis on annual and long-term incentive plan development.

In Botoff’s upcoming 2025 flagship US Compensation Report for Family Offices, Family Investment Firms, and Private Trust Companies, to be released this fall, survey respondents reported that 51 per cent of all single family offices use long-term incentive (LTI) plans, including 46 per cent of firms with less than $2.5 billion in AuM and 67 per cent of firms with $2.5 billion in AuM or more.

Following a 2024 trend shift, deferred incentive compensation returned to the most prevalent plan type (51 per cent), followed by co-investment opportunity (43 per cent) and carried interest (33 per cent).

Botoff Consulting argues that the costly risks of overpaying, underpaying, or misaligning incentives with actual performance alone justify the effort, but with pay transparency laws gaining momentum, the stakes are even higher. In many jurisdictions, being able to justify pay decisions using accurate, defensible data is both a best practice and a compliance requirement, it says.

“Reliable compensation data, when paired with expert consultants

who understand the family office landscape, becomes a powerful

strategic tool. Together, they enable leaders to design pay plans

that reflect market realities while aligning with a family’s

unique goals, values, and structure. In today’s environment,

where transparency and compliance are increasingly critical, this

combination is not just smart - it is essential,‚ÄĚ the firm

adds.